Board Officers

Chair

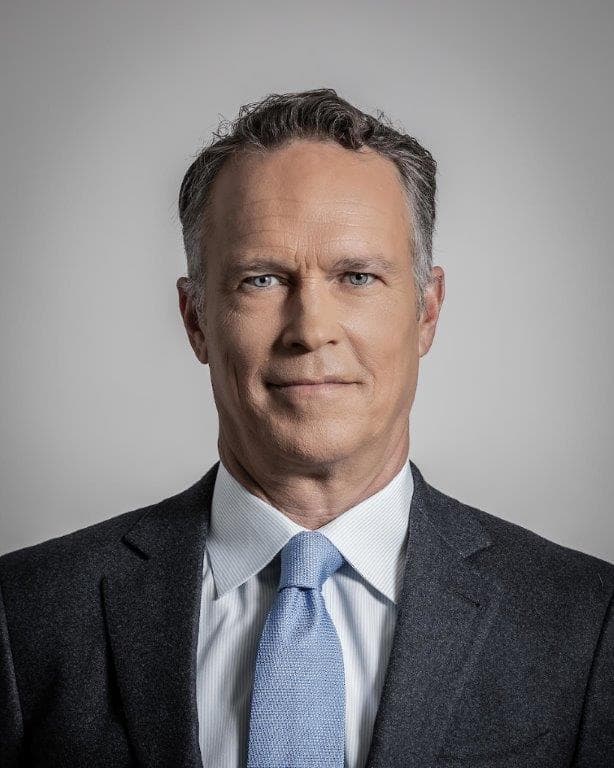

David Allen, CFA

Octane

2023-2024

David Allen, CFA, is the Chair of the Board of the CFA Society of New York. He is also Managing Director at Octane Investments, a firm he founded to invest in traditional energy companies. Prior to this, he served large institutions at Schroders and served in a similar position at AB, for nearly a decade at each of those firms. He also has founded and ran two FinTech startups and he traded FX in the 1990s. He earned a bachelor’s degree at the University of Pennsylvania in Economics and completed the Value Investing executive education curriculum at Columbia University. Allen is Chair of the NY Society’s Programming Committee, and recently passed the CFA Institute’s ESG certification.

Vice Chair

Ken D’Souza, CFA

PGIM Quantitative Solutions

2023-2025

Ken D’Souza, CFA, is a Managing Director and Portfolio Manager for PGIM Quantitative Solutions working within the Quantitative Equity team. He oversees the analysts on the Quantitative Equity Team and is responsible for portfolio management, analysis and research. Prior to joining PGIM Quantitative Solutions, Ken was a Portfolio Manager at Batterymarch Financial Management where he utilized a blend of quantitative, fundamental and macroeconomic insights. Prior to Batterymarch, he was a research and development engineer and manager at Shaw Industries (Berkshire Hathaway). He is a past president and member of the Board of Directors of the Society of Quantitative Analysts and has served on the Board of Directors of the CFA Society New York and CFA Society Boston. He has also lectured on Financial Risk Management at Columbia University. Ken earned a BS in chemical engineering from the Georgia Institute of Technology, an MS in both management science and engineering from Stanford University and an MBA from the University of Chicago, graduating as an Amy and Richard F. Wallman Scholar.

Treasurer

Thomas Brigandi, CFA

RisCura

2024-2026

Thomas Brigandi, CFA, is a Managing Director at RisCura, the largest emerging & frontier market-dedicated investment consultancy by assets under advisement (AUA), with over US$200 billion. RisCura also manages / administers roughly $10 billion in assets. Prior to joining RisCura, Brigandi served as a Vice President in the Global Investor Management Team at Moody’s Investors Service (MIS), where he was responsible for building and maintaining senior level institutional investor relationships. Prior to serving in the Global Investor Management Team, Brigandi served for nearly a decade in the Global Project and Infrastructure Finance Group at MIS, where he was a Lead Analyst responsible for a portfolio of 34 power, toll-road, airport, port, water, wastewater, natural gas pipeline and project finance credits that collectively had over $15 billion of debt outstanding. While a Lead Analyst, Brigandi served on Moody’s public pension steering committee, ESG Americas working group and veteran recruiting sub-committee. Prior to Moody’s, Brigandi worked at the ~$250bn NYC Pension Fund, where he focused on energy and natural resources and reported directly to the chief investment officer.

Brigandi is Chair of the Board of Directors of CFA Society New York (CFANY), one of the largest CFA Institute Societies. Brigandi, the CFA Institute Inaugural Global Outstanding Young Leader & 2021 Americas Volunteer of the Year, has organized over 90 in-person CFA Society conferences globally that were attended by over 17,000 investment professionals, in addition to over 50 virtual conferences that reached many thousands of participants. These events featured over 400 senior asset owner and investment consultant speakers who represent organizations that collectively oversee or advise on more than $75 trillion in fiduciary assets. Brigandi, the founder of CFANY’s Asset Owner Series, Global Policymakers Series, Emerging and Frontier Market Series and Putting Beneficiaries First Series, leads a team of several hundred investment professional volunteers globally.

Brigandi maintains over 14,000 connections on LinkedIn and holds a Bachelor of Science in Finance, Accounting and Economics from the Macaulay Honors College (MHC) at the City University of New York. Brigandi received the college’s inaugural Alumni Pioneer Award and serves on the MHC Foundation Board of Directors as Treasurer. Brigandi serves as a Board Member of The Ocean Foundation, an Advisory Board Member of the Singapore Economic Forum, a Bretton Woods Committee Member and a Fellow of the Foreign Policy Association.

Secretary

Caroline Busby, CFA

BlackRock

2023-2025

Caroline Busby, CFA, leads product, policy, and regulatory initiatives for BlackRock’s US Fixed Income ETF business through the evolution of existing products and the broader fixed income ecosystem to meet the needs of institutional investors. She is responsible for developing the operating strategy and aligning to business priorities across BlackRock. Her role requires subject matter expertise across a range of disciplines where fixed income ETF investor adoption is challenged or existing processes require modernization: e.g., US GAAP accounting, US withholding tax practices, FHLB financing, state insurance regulation. Prior to her current role, Caroline was on the iShares Institutional Fixed Income ETF Sales Team at BlackRock and also held roles at AllianceBernstein.

At BlackRock, Caroline is Global Chair of the Green Team Network (“GTN”), a 4,300+ employee network with a mission to drive sustainable change in global offices and local communities. She also co-created the BlackRock CFA Group to increase connectivity among the CFA Charterholder and exam candidate community. Before being elected to the CFANY Board of Directors, Caroline served as Co-Chair of their Young Leaders Group and as Co-Head of their Diversity & Inclusion Forum.

Caroline graduated from Georgetown University with a double major in Finance and Management from the McDonough School of Business.

![Arthur Fliegelman LinkedIn photo 2749[1]](https://cfany.org/wp-content/uploads/2022/03/Arthur-Fliegelman-LinkedIn-photo-27491.jpg)

Karen E. Boroff, PhD, is a professor in the Department of Management at the Stillman School of Business. Previously, she was on a one-year assignment as a visiting professor at the United States Military Academy. She was also the dean of Seton Hall University’s Stillman School of Business from 2000 to 2010. Under her leadership, the school was recently reaccredited by the premier accrediting agency of business schools, the AACSB, and was also awarded the prestigious accounting accreditation. She initiated the development of a code of conduct for the Stillman School, as well as a lecture series focused on integrity in business practice. During her tenure, the school opened its Trading Room, Seton Hall Sports Polling Center, and Entrepreneurship Center. The school tremendously increased its international outreach, especially with excellent colleges in China. The school has earned national distinctions for its undergraduate and graduate programs, as cited in such rankings as Bloomberg, BusinessWeek, US News and World Report, Entrepreneurship 2.0, and the Princeton Review. In January 2008, the school earned the Council on Higher Education Accreditations award on Institutional Outcomes Assessment. Boroff earned a PhD in business from Columbia University, an MBA from Lehigh University and a BS in industrial and labor relations from Cornell University.

Karen E. Boroff, PhD, is a professor in the Department of Management at the Stillman School of Business. Previously, she was on a one-year assignment as a visiting professor at the United States Military Academy. She was also the dean of Seton Hall University’s Stillman School of Business from 2000 to 2010. Under her leadership, the school was recently reaccredited by the premier accrediting agency of business schools, the AACSB, and was also awarded the prestigious accounting accreditation. She initiated the development of a code of conduct for the Stillman School, as well as a lecture series focused on integrity in business practice. During her tenure, the school opened its Trading Room, Seton Hall Sports Polling Center, and Entrepreneurship Center. The school tremendously increased its international outreach, especially with excellent colleges in China. The school has earned national distinctions for its undergraduate and graduate programs, as cited in such rankings as Bloomberg, BusinessWeek, US News and World Report, Entrepreneurship 2.0, and the Princeton Review. In January 2008, the school earned the Council on Higher Education Accreditations award on Institutional Outcomes Assessment. Boroff earned a PhD in business from Columbia University, an MBA from Lehigh University and a BS in industrial and labor relations from Cornell University.